W44 2024: Wheat Weekly Update

.jpg)

1. Weekly News

Europe

EU Wheat Exports Dropped 31% YoY in the First Half of the 2024/25 Season

European Union (EU) wheat exports dropped by 31% year-on-year (YoY) in the first half of the 2024/25 season, with much of the EU’s wheat imports now coming from Ukraine. Wheat prices in Paris have fallen due to sluggish EU exports, prominent United States (US) harvests, and vigorous export activity from Russia. The European Commission (EC) reported that EU common wheat exports reached 7.0 million metric tons (mmt) from July 1 to October 20, down from 10.2 mmt over the same period last year.

Brazil

Heavy Rains Impacted Wheat Harvest in Southern Brazil

Heavy rains in southern Brazil have been damaging wheat crops, particularly in Rio Grande do Sul. Consequently, many wheat farmers surveyed by the Center for Advanced Studies on Applied Economics (CEPEA) have paused spot market negotiations, waiting for further harvest progress. Those continuing to sell have been more flexible with offer prices, acknowledging potential declines in grain quality due to adverse weather. Wheat prices in São Paulo have substantially risen, driven by the state's low productivity. According to National Supply Company (CONAB) data, 98% of the wheat area in São Paulo has already been harvested.

Canada

Canada Set to Retain Position as World’s Third-Largest Wheat Exporter

Canada is on track to remain the world’s third-largest wheat exporter for a second consecutive year in 2024, as rising crop production in the prairie provinces bolsters its export position. Data from the United States Department of Agriculture (USDA) shows Canada surpassing Australia in the 2023/24 crop year and projects a similar ranking for 2024/25, with only Russia and the EU ahead in wheat export volumes. Agriculture and Agri-Food Canada (AAFC) outlook estimates that Canada’s production of all principal field crops will rise by 1.8% YoY and 2.4% above the five-year average. This growth reflects a largely completed fall harvest with improved yields in Western Canada, where drought conditions have eased compared to the previous year. Despite last year’s drought, Canada still ranked third in wheat production, as Australian farmers faced weather-related challenges that affected crop volumes.

Russia

Russia's Wheat Exports Set New Record in Oct-24

Russia's wheat export forecast for Oct-24 has been revised upward to 5.9 mmt, setting a historical record for monthly exports, surpassing Oct-23's 5.12 mmt. For the Jul-24 to Oct-24 period, total wheat exports from Russia are projected to reach 20.8 mmt, exceeding last year's 20.2 million tonnes. Moreover, Nov-24 wheat exports are also expected to exceed last year's level, with a forecast range of 4.6 to 4.8 mmt, compared to 3.49 mmt in Nov-23. Russia's grain exports for the last agricultural season totaled 72 mmt, including 54.1 mmt of wheat.

United States

Persistent Drought Expected in the US Wheat Regions for Winter 2024/25

The National Oceanic and Atmospheric Administration (NOAA) forecasts drought will likely persist or worsen in key US wheat-growing regions this winter. A developing La Niña pattern will shape US weather from Dec-24 to Feb-25. NOAA predicts wetter-than-average conditions for the northern US, especially in the Pacific Northwest and Great Lakes areas. However, drier-than-average conditions will likely affect the southern US, covering much of the critical winter wheat-producing regions.

2. Weekly Pricing

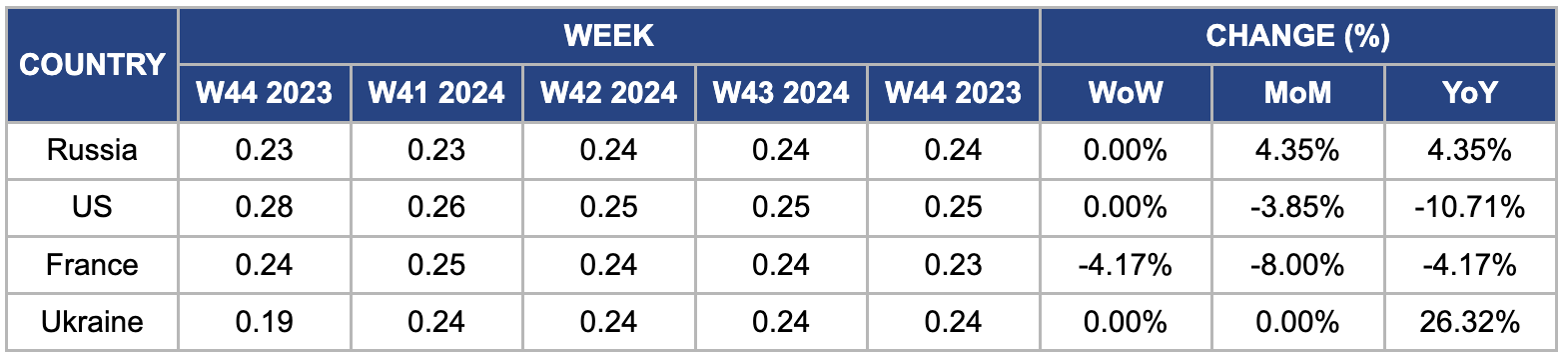

Weekly Wheat Pricing Important Exporters (USD/kg)

Yearly Change in Wheat Pricing Important Exporters (W44 2023 to W44 2024)

Russia

In W44, Russian wheat prices remained stable week-on-week (WoW) but rose by 4.35% month-on-month (MoM) and YoY, reaching USD 0.24 per kilogram (kg). This increase is due to severe drought conditions, particularly in Oryol, which has declared a state of emergency. The extreme weather and early frosts have adversely affected the 2024/25 wheat production forecast, creating challenges for farmers in wheat sales and reducing market liquidity. Concerns over winter planting for the 2025/26 crop have led the Russian Grain Union (RGU) to call for export restrictions and reevaluate the export quota methodology to better align with global demand and seasonal capacity.

United States

In W44, US wheat prices remained unchanged WoW at USD 0.25/kg. However, prices fell by 3.85% MoM and 10.71% YoY, primarily due to increased supply. The USDA's weekly crop progress report highlighted concerns over US winter wheat conditions. As of October 27, only 38% of US winter wheat had a good or excellent rating, significantly lower than last year's initial rating of 47% and the five-year average of 43.4%. This is also below the average analyst expectation of 47% (LSEG) and among the worst ratings for this time of year, just above 2022. The poor condition of the crop is attributed to a lack of rainfall, raising concerns about the 2025 harvest yields. Drought conditions have worsened recently, with 58% of the US winter wheat area affected by drought as of October 22, up from 52% the previous week and 47% two weeks earlier.

France

In W44, French wheat prices fell by 4.17% WoW and 8% MoM to USD 0.23/kg, despite the International Grains Council's (IGC) revised global wheat production forecast for the 2024/25 season. The price decline is due to poor harvest conditions in France, where heavy rainfall has damaged crops. This situation raises concerns about export sales, especially to critical markets like Morocco and Tunisia, historically major destinations for French wheat. As they begin their southern hemisphere harvest, diplomatic tensions with Algeria and increasing competition from Argentina and Australia are further weighing on the market.

Ukraine

Ukrainian wheat prices remained stable WoW and MoM in W44 but saw a significant 26.32% increase YoY, reaching USD 0.24/kg. This price rise is due to concerns over drought conditions affecting winter wheat planting for the 2025 harvest. The ongoing war and adverse weather have reduced the area sown with winter wheat, estimated at approximately 4.2 million hectares (ha) in 2024, down from 4.4 million ha the previous year. The expected smaller harvest and lower carryover stocks have further limited the exportable surplus, placing additional upward pressure on prices.

3. Actionable Recommendations

Develop Resilient Wheat Production Systems Using Technology

Russian wheat farmers should adopt advanced agricultural technologies, such as precision farming and intelligent irrigation systems, to tackle the challenges posed by extreme weather events like droughts. Farmers can optimize water usage, soil management, and pest control using data-driven insights, leading to more resilient wheat production. Furthermore, integrating weather prediction tools into farming operations can help farmers better plan for adverse conditions, allowing them to decide when to plant, irrigate, or harvest. These innovations can help increase the efficiency of wheat production, reduce losses from unpredictable weather, and maintain competitiveness in global markets despite climatic challenges.

Adoption of Climate-Resilient Wheat Varieties and Flexible Harvesting Methods

Brazilian wheat farmers should adopt more climate-resilient varieties, particularly those bred to withstand heavy rainfall and fluctuating temperatures. These varieties can help mitigate the impact of adverse weather conditions, such as the floods and rains currently damaging crops in Rio Grande do Sul. Moreover, incorporating flexible harvesting techniques, like early harvesting or staggered planting, can help farmers adjust to unpredictable weather patterns. Investing in improved drying and storage technologies will ensure that crops are recovered to suitable weather conditions, increasing overall crop yield despite challenges. Farmers can also consider diversifying wheat production with other crops to reduce the financial risks tied to wheat alone.

Invest in Wheat Quality and Branding for New Markets

The EU should focus on enhancing the quality and branding of its wheat to differentiate itself in global markets. Since wheat exports have dropped significantly, a focused effort to position EU wheat as a high-quality, sustainable product could help open new trade channels. Creating specialized wheat varieties suited for specific consumer needs, such as high-protein or organic wheat, could attract premium buyers, especially in niche markets like organic food or health-focused industries. EU exporters should also participate in global trade shows, build stronger relationships with international buyers, and promote their wheat's sustainability credentials to boost demand and justify a price premium.

Sources: Timescolonist, UkrAgroConsult, Agri, Opresenterural, Kvedomosti, Ahdb