W4 2025: Soybean Weekly Update

In W4 in the soybean landscape, some of the most relevant trends included

- 2024/25 MY is projected to reach a record 424.3 mmt, with a decrease in the stock-to-consumption ratio to 31.7%. However, US production estimates were reduced by 2% YoY, leading to a 19% decrease in ending stocks.

- Adverse weather conditions have slowed Brazilian harvest progress. As of mid-Jan-25, only 1.7% of the area had been harvested, significantly behind 2024 and 2023.

- Brazilian soybean prices fell WoW due to an increased production forecast. Meanwhile, US soybean prices rose WoW due to strong demand and reduced production forecast.

- In Argentina, prices rose MoM due to drought concerns, while Uruguay's soybean prices remained steady.

1. Weekly News

Global

2024/25 Global Soybean Production Forecast Reaches Record 424.3 MMT

Global soybean production for the 2024/25 marketing year (MY) is projected to reach a record 424.3 million metric tons (mmt), with the stock-to-consumption ratio decreasing to 31.7%. The United States Department of Agriculture (USDA) has reduced United States (US) production estimates by 2% year-on-year (YoY), leading to a 19% decrease in ending stocks. Meanwhile, 87% of Argentina's planned soybean crop is in normal to good condition. However, insufficient rainfall raises concerns about potential yield losses. Despite these developments, local soybean markets are experiencing a downward price trend, with fluctuations in US production and Brazilian weather conditions likely to influence the global soybean complex.

Brazil

Brazil's 2024/25 Soybean Harvest Faces Delayed Progress Due to Adverse Weather

The Brazilian 2024/25 soybean harvest faces challenges due to adverse weather conditions. Low humidity in the South and Southern Mato Grosso do Sul has hindered crop grain-filling potential. Meanwhile, excessive rainfall has affected regions in Mato Grosso and parts of the Center-West, Southeast, and Northeast, disrupting harvest progress. As of January 16, only 1.7% of the cultivated soybean area in Brazil had been harvested, up from 0.3% a week earlier but significantly behind the 6% recorded during the same period in 2024. This figure is comparable to the 1.8% achieved during the 2022/23 harvest but represents the slowest harvest progress for this time of year since the 2020/21 season. The harvest pace in Mato Grosso is particularly concerning, marking the slowest start.

China

China Shifts Focus to Brazilian Soybeans for Q1-25 Imports

In Q4-24, Chinese soybean processors shifted their focus to Brazilian soybeans for Q1-25 imports, driven by lower costs, favorable weather conditions, and the depreciation of the Brazilian Real (BRL), which enhances export competitiveness. Concerns over potential US import tariffs under the new administration influenced this move. Brazil accounted for 54% of China’s Q1-24 soybean imports. However, China's Q1-25 soybean imports are expected to decline due to oversupply from 2024 and anticipation of new Brazilian crops.

Ukraine

Ukraine's 2024 Soybean Harvest Reaches Record Despite Lowest Yield in Four Seasons

Ukraine's 2024 soybean harvest stood at 6.23 mmt, a notable increase from 5.26 mmt in 2023. However, the final soybean yield is projected to decline to 2.35 metric tons (mt) per hectare (ha), marking the lowest in four seasons. The general upward trend in oilseed prices and the high margins from the 2023/24 season were key drivers of farmers' interest in oilseeds. Soybean profitability shifted from negative to positive, prompting a 35% YoY expansion in the planting area, up 700 thousand ha to a record 2.7 million ha. Despite the increased area, dry and hot summer conditions have negatively impacted spring crops, contributing to the expected lower yields.

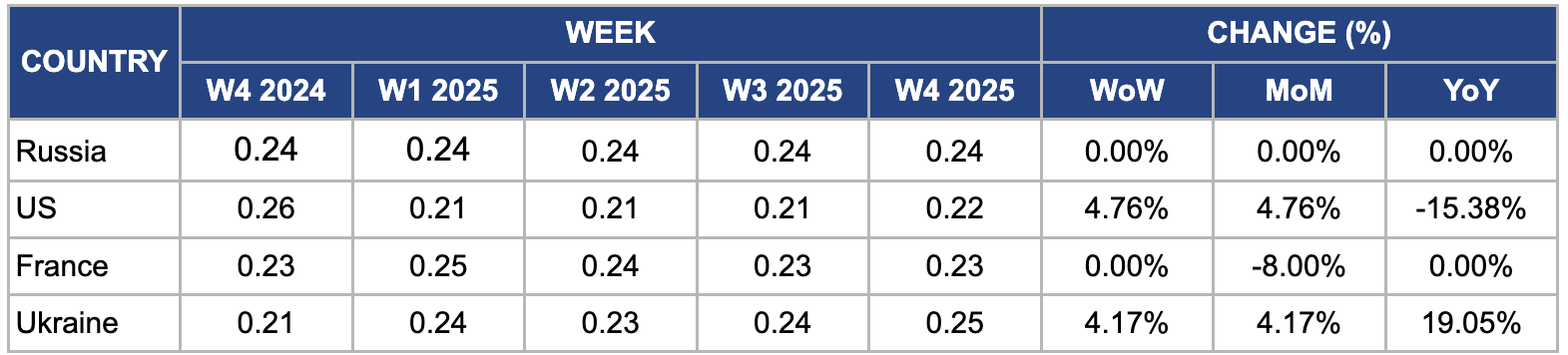

2. Weekly Pricing

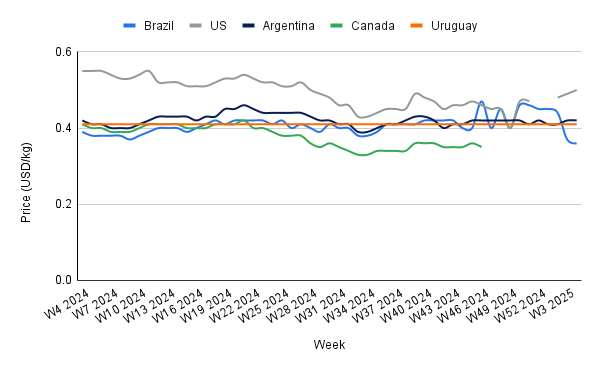

Weekly Soybean Pricing Important Exporters (USD/kg)

Yearly Change in Soybean Pricing Important Exporters (W4 2024 to W4 2025)

Brazil

In W4, Brazilian soybean prices fell by 2.70% week-on-week (WoW), 20% month-on-month (MoM), and 7.69% YoY, reaching USD 0.36 per kilogram (kg). This price decline comes amid the Brazilian Association of Vegetable Oil Industries (ABIOVE) projecting a record soybean harvest of 171.7 mmt for 2025, an increase of 3 mmt from Dec-24's forecast. This marks an 11.9% rise compared to the 2024 season. Export expectations for Brazil have also been upgraded, with a historic level of 106.1 mmt anticipated, a 7.4% increase compared to 2024. Moreover, soybean processing in Brazil is expected to reach a record 57.1 mmt in 2025, with soybean meal and oil production projected to grow by 3.8% and 3.6%, respectively, compared to 2024.

United States

In W4, US soybean prices increased by 2.04% WoW, rising to USD 0.50/kg from USD 0.49/kg. This price increase followed a strong demand and downward revision of the USDA's 2024/25 soybean production forecast to 2.58 mmt, which adjusted the expected stock levels. The lower production estimate is primarily attributed to a 1.93% YoY yield decline, leading to tighter end-of-season stocks. The USDA identified states such as Indiana, Kansas, South Dakota, Illinois, Iowa, and Ohio as the most affected by the reduced production.

Argentina

In W4, Argentinian soybean prices remained stable WoW but rose by 2.44% MoM, reaching USD 0.42/kg. This price increase is due to concerns over potential crop yield reductions due to drought. Adverse weather conditions, such as high summer temperatures and limited rainfall, have negatively impacted soybean crop yields and quality. Moreover, the Buenos Aires Grain Exchange (BAGE) adjusted its 2024/25 planting estimates, reducing the projected soybean area by 200 thousand ha to 18.4 million ha while increasing the corn area by 300 thousand ha. This shift is attributed to the declining profitability of soybeans, prompting farmers to turn to more profitable crops like corn. Argentina's soybean production for the 2025 harvest will range between 52 and 55 mmt, with weather conditions remaining a critical factor in determining the final yield.

Uruguay

In W4, Uruguay's soybean prices held steady at USD 0.41/kg, supported by key factors such as favorable market conditions and the expansion of planting area. For the 2024/25 MY, Uruguay's soybean planting area is projected to reach 1.3 million ha, a 19% increase from the five-year average. This growth is attributed to late-season soybean planting as producers brace for potential challenges from the La Niña weather pattern. The USDA forecasts Uruguay's soybean production for 2024/25 at 3.4 mmt, up from 3.2 mmt in the previous year due to favorable weather conditions.

3. Actionable Recommendations

Monitor Weather Patterns for Impact on Soybean Yields

In regions like Argentina and Brazil, the ongoing challenges from adverse weather conditions, including drought and excessive rainfall, are expected to influence soybean yields. Therefore, it is critical to monitor weather patterns closely. Local governments and farmers should invest in weather forecasting technologies and implement advanced irrigation techniques and drought-resistant crop varieties. In Brazil, the slow harvest progress and uneven conditions in key soybean-producing states underscore the need for better preparation and responsive strategies. Developing predictive models to anticipate weather-related disruptions can help stakeholders make timely decisions on crop management, thereby reducing the risks associated with fluctuating yields.

Enhance Export Strategies in Response to Changing Market Dynamics

Exporters should adapt their strategies as global soybean demand shifts, particularly with China turning to Brazil due to favorable pricing and weather conditions. Brazil’s expanding export expectations, driven by a strong 2025 harvest forecast and competitive pricing, indicate a growing opportunity in Asian markets, especially for Q1-25 imports. To maintain their competitive edge, Brazilian exporters should improve logistical efficiencies, secure favorable trade agreements, and capitalize on depreciating BRL to maintain strong demand from key buyers like China. Moreover, with Argentina shifting its focus to corn due to soybean profitability concerns, soybean exporters should look for new opportunities in alternative regions to balance market dynamics and ensure steady revenue streams.

Support Sustainable Agricultural Practices to Improve Long-Term Productivity

With the increasing volatility in soybean prices and production, especially in countries like Argentina and Ukraine, farmers should focus on improving soil health and crop rotation and use sustainable fertilizers to increase resilience and yield potential. By promoting soil conservation techniques and reducing dependency on chemical inputs, countries like Argentina and Ukraine can help stabilize yields over time, reducing the impact of weather-related fluctuations and improving overall market competitiveness in the global soybean complex.

Sources: Tridge, Chacra Magazine, NoticiasAgricolas, UkrAgroConsult