W36 2024: Mango Weekly Update

1. Weekly News

Australia

Northern Territory Mango Season Picks Up with Promising Forecast

The mango season in Australia’s Northern Territory (NT) is gaining momentum, with 24 thousand trays of mangoes shipped to markets in W35. The Darwin region is expected to produce 2.4 million trays in 2024, a slight increase from 2023. Current harvests are inconsistent due to several flowering events, yet prices remain favorable. Premium mangoes are priced at USD 60 per tray, and the outlook for forthcoming fruit is promising. The season in Darwin is set to peak in mid-Oct-24, bringing a robust supply to supermarkets. Crop forecasts for the Katherine area, as well as Kununurra in Western Australia and growing regions in Queensland, will be released in the coming weeks. In Katherine, strong flowering is anticipated to lead to a good harvest of Kensington Pride and R2E2 mangoes starting in late Sep-24. The Australian mango industry aims to recover from a challenging 2023/24 season. The national harvest historically exceeds 10 million trays, and the NT produces over half of the country's mangoes.

Egypt

Egypt’s Mango Season Nears End with Strong Production and High Demand

According to industry reports, the Egyptian mango season is coming to a close, marked by high production volumes and strong demand. In 2024, Egypt produced over 2 million tons of mangoes, with cultivation exceeding 100 thousand hectares (ha). Mangoes ranked second in export volume after citrus fruits. Despite concerns over low prices due to high production, demand remains strong, mainly from Europe, Russia, and Gulf countries. Exporters expect prices to rise as the season winds down, with increased export activity anticipated in the coming months.

Egypt Prepares for Chinese Approval of Mango Farms and Stations

The Central Administration of Agricultural Quarantine (CAPQ) supervised a two-day remote video inspection of Egyptian mango farms and stations, preparing for approval from the Chinese authorities. Officials from the Plant Health Unit, Exporters Service Department, and agricultural quarantine inspectors reviewed plant health procedures and monitoring systems. The Central Laboratory for Analysis of Pesticide Residues highlighted its role in supporting the process, while the Plant Protection Research Institute outlined pest classification efforts. The Trade Representation Office in Beijing coordinated the inspection and completed translations. Positive feedback from the Chinese side followed the clarification of technical details, including coding operations, pest surveys, and plant health treatments.

Ivory Coast

Ivorian Mango Campaign Thrives Despite Shortened Season

The Ivorian mango season has been successful in 2024 due to favorable weather and strong European demand. The Kent variety was popular among European clients and saw excellent results with optimal production conditions, including good rainfall and warm weather. Overall, mango production on the Ivory Coast reached 180 thousand tons. Moreover, Europe received 32 thousand tons of Ivorian mangoes in 2024 so far, despite high competition from other West African and Asian suppliers. However, the season was shortened starting in Jul-24 due to heavy rains and increased fruit fly infestation. Prices remained steady at around USD 0.34 per kilogram (XAF 200/kg), comparable to last year and higher than those from Mali or Senegal.

Mexico

Northern Sinaloa Mango Season Ends with Lower Production and Steady Prices

The mango season in northern Sinaloa is winding down, with an expected total of 16 million 4-kg boxes exported to the United States (US) from 11 thousand ha of orchards. Due to drought conditions, the mango production in 2024 is lower than in 2023. The season, which started earlier than usual, faced challenges such as reduced water supply, affecting fruit development. Despite these issues, the export volume is anticipated to be around 16 million boxes, close to the average. Mango prices have been slightly higher than last year due to peso-dollar parity, though the increase is insignificant. During the season, northern Sinaloa exported up to 2 million boxes of mangoes weekly, a volume that remained within market limits and helped prevent negative impacts on prices.

United States

US Mango Imports Slightly Increased in W34

According to the National Mango Board (NMB)'s W34 report, about 2.73 million 4-kg boxes of mangoes were shipped to the US market by August 24, 2024. This volume is slightly higher than the 2.64 million boxes shipped in the same week last year. Keitt mangoes comprised 91% of the shipments, with smaller supplies of Ataúlfo, Kent, Mallika, and Manila Rosa. Mexico's regions of Jalisco, Nayarit, and Sinaloa remain active in harvesting and packing. Due to logistical reasons, no shipments were made from Brazil in W34, but harvests continued. Overall, mango shipments are expected to rise by 6% between W35 and W40 compared to last year.

2. Weekly Pricing

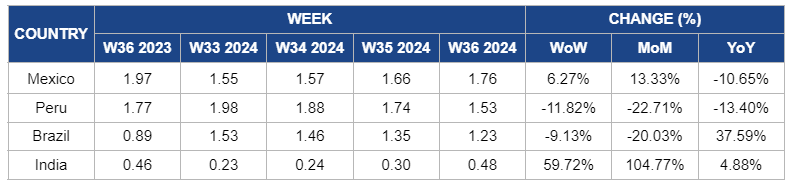

Weekly Mango Pricing Important Exporters (USD/kg)

* Varieties: Mexico (Manilla), Peru (Kent), Brazil (Tommy), and India (overall average)

Yearly Change in Mango Pricing Important Exporters (W36 2023 to W36 2024)

* Varieties: Mexico (Manilla), Peru (Kent), Brazil (Tommy), and India (overall average)

* Blank spaces on the graph signify data unavailability stemming from factors like supply unavailability, missing data, or seasonality

Mexico

In Mexico, mango prices increased by 6.27% week-on-week (WoW) to USD 1.76/kg in W36, with a 13.33% month-on-month (MoM) increase. This is due to tighter supply conditions, adverse weather in major production regions, such as Malaga, Spain, and reduced global mango availability. Additionally, higher demand for Mexican exports has increased prices, as Mexico is seen as an alternative source for importers facing shortages from other countries. However, YoY prices declined by 10.65% compared with last year's higher prices, which were driven by severe supply shortages and market tightness in W35 2023. Improved supply levels this year have helped keep prices lower than the elevated figures from the previous year.

Peru

Peruvian mango prices dropped by 11.82% WoW to USD 1.53/kg in W36, compared to last week's price of USD 1.74/kg. There is a 22.71% MoM decrease and a 13.4% year-on-year (YoY) reduction. This continued price decline is due to the ongoing recovery of mango production for the 2024/25 season, leading to increased supply levels that place downward pressure on prices. Additionally, logistical challenges, such as delays at the Panama Canal, continue to disrupt the supply chain, further contributing to the price drop. The heightened competition from other exporters like Brazil has also intensified market competition, influencing the downward price trend.

Brazil

In W36, mango prices in Brazil fell by 9.13% WoW to USD 1.23/kg, with a 20.03% MoM decrease. This is due to increased domestic supply and a continued drop in export demand, particularly in major producing regions like the São Francisco Valley and Livramento de Nossa Senhora. The market's seasonal dynamics and reduced export orders further contributed to the price decline. However, looking at YoY prices, mango prices rose to 47.59% due to last year's significantly lower production levels and stronger export demand, creating a lower base for comparison and driving the YoY increase.

India

India's mango prices skyrocketed by 59.72% WoW to USD 0.48/kg in W36, up from USD 0.30/kg in W35. Additionally, prices saw a substantial 104.77% MoM increase and a 4.88% YoY rise. This significant price surge is primarily driven by a sharp increase in domestic demand amidst limited supply as exporters continue to prioritize fulfilling international orders. Additionally, the higher prices reflect the tightening of supply as the market recovers from last year's oversupply. The combination of robust demand reduced available volumes, and strong export activity has exerted upward pressure on prices across all comparisons.

3. Actionable Recommendations

Enhance Water Management and Invest in Drought-Resistant Mango Varieties

Mango growers in northern Sinaloa, Mexico, should enhance water management practices and invest in drought-resistant mango varieties to mitigate the impact of reduced water supply and improve fruit development. Implementing advanced irrigation systems, such as drip irrigation, and adopting water-saving technologies will optimize water use and support consistent fruit growth. Additionally, investing in drought-resistant mango varieties will ensure better resilience to future water shortages. These measures will help stabilize production levels, sustain export volumes, and maintain price stability despite climatic challenges.

Optimize Harvest Timing and Monitor Crop Conditions

To ensure consistent production, mango growers in the Northern Territory, Australia should optimize harvest timing by closely monitoring crop conditions and flowering events. By adjusting harvesting schedules and focusing on optimal fruit maturity, growers can maximize tray yields and maintain premium pricing. This approach will help secure favorable market positioning during the peak season in mid-October and support a strong recovery from last year’s challenges.

Sources: Tridge, MXfruit, Agriculture Egypt, Eastfruit, Luznoticias, Agraria, Eastfruit, Freshplaza